salt tax deduction news

12There has been a lot of discussion amongst government leaders about the cap on state and local. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to 1 million.

The Impact Of Eliminating The State And Local Tax Deduction Report

Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed.

. Colorado lawmakers advance a retroactive SALT cap workaround. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. That was bad news for top earners in blue states such as California and New York.

The bill would make a workaround to the federal 10000 cap on state and local tax deduction retroactive to 2018. April 18 2022 146 PM 4 min read. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030.

Republicans established the 10000 cap on the SALT deduction in an effort to raise revenue to help offset the cost of tax cuts elsewhere in their 2017 law which reduced the corporate tax rate. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local property.

As Congress struggles to pass the Build Back Better bill some congressional Democrats are exploring new proposals to raise the 10000 cap on the state and local tax SALT deduction. Americans who rely on the state and local tax SALT deduction at tax time may be in luck. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill.

Bloomberg Law -- The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed. Paying a state income tax of 10 percent or more. FILE - Rep.

Since 2018 taxpayers living in high-tax states have been unable to take an itemized deduction of state and local taxes over a limitation known. Tom WilliamsCQ-Roll Call Inc. December 12 2021 318 PM PST.

However nearly 20 states now offer a workaround that allows. Bill Ackman says that raising the state and local tax deduction -- known as SALT -- to 80000 makes no sense joining the debate over a contentious issue in. For the latest tax news subscribe to the Tax Policy Centers Daily Deduction.

Mikie Sherrill D-NJ conducts a news conference to advocate for inclusion of the state and local tax SALT deduction in the Build Back Better Act reconciliation bill outside the U. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year. The states original fix was only effective beginning this year.

The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. However many filers dont know. But the Tax Cuts and Jobs Act limited that deduction to 10000.

December 12 2021 930 AM 4 min read. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. State Local Tax SALT The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated taxable income or.

52 rows Like the standard deduction the SALT deduction lowers your adjusted gross income AGI. Then you can deduct either the amount you paid for state and local. Erin Cleavenger The Dominion Post Morgantown WVa.

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for. This differs from a credit which decreases the amount you owe also known as taxable income after youve calculated your AGI Everyone claiming the SALT deduction can deduct their property taxes. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

The Supporting Americans with Lower Taxes SALT Act sponsored by US.

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

What Is Salt Tax Deduction Mansion Global

Steve Rattner Breaks Down Impact Of Salt Deduction Cap Morning Joe Msnbc Youtube

This Bill Could Give You A 60 000 Tax Deduction

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

By Backing A Huge Tax Giveaway To The Rich Democrats Are Giving The Gop A Perfect Midterm Gift

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

Salt Deduction Biden S Spending Bill Why A Flat Tax Should Be Considered Steve Forbes Forbes Youtube

Use Our Tax Calculators And Find Great Information About Taxes Estate Tax Property Tax Tax Deductions

State And Local Tax Deductions Moving To A Consensus On Build Back Better By Ira Kawaller Perceive More Medium

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Who Can Take The New Business Tax Deduction Even Tax Experts Aren T Sure Utica New York Emotional Wellness National Sleep Foundation

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

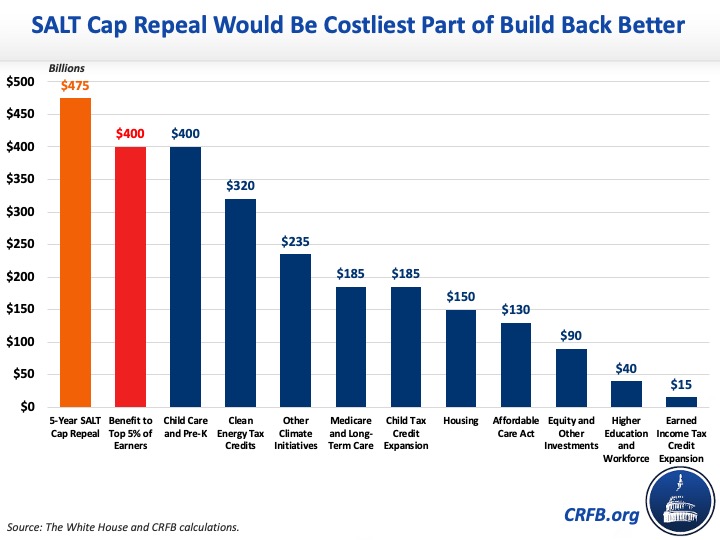

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget